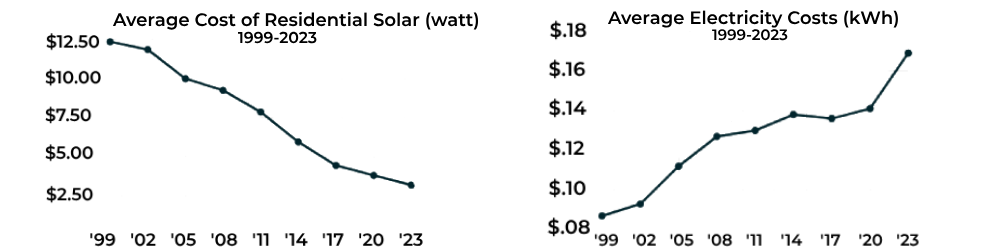

SuperGreen Solutions has proudly served South Carolina as a leading solar partner for over a decade, and now is the ideal moment to transition to solar energy! South Carolina has surged ahead in solar installations, ranking among the nation’s top states, thanks to a substantial 43% decrease in solar prices over the last decade and escalating energy expenses. This momentum is fueled by a combination of rising energy costs and appealing solar incentives.

Switching to solar power not only slashes electricity bills but also fosters a cleaner environment. Solar panels not only generate power for your home but also channel surplus energy back into the grid. With SuperGreen Solutions, embrace a greener future for South Carolina while enjoying more outdoor activities and saving money on energy bills.

Take control of your rising electricity costs and gain energy independence

SuperGreen Solutions, headquartered in Bel Air, Maryland, leads in the clean energy sector with a focus on transparency and accountability. Since 2011, we’ve specialized in green initiatives like solar planning and EV charging. Committed to ethical sourcing and global quality standards, we aim to shape an energy-efficient future. As your sustainability ally, we offer expert-guided, comprehensive green energy solutions.

Aligned with the Solar Energy Industries Association (SEIA), we adhere to the Solar Supply Chain Traceability Protocol for traceable solar panels. Future plans involve expanding environmental offerings, amplifying marginalized voices, and advocating for universal sustainability, ensuring resources are accessible to all.

SuperGreen proudly installs ethically sourced solar technology at the most competitive pricing by bypassing extra costs of the middlemen and selling to you directly.

Ranked #9 in the US for solar incentives

Limited time 30% tax credit for the entire cost of your solar installation.

Local utility providers may offer additional solar incentives.

In South Carolina, property tax is prevented from increasing as a result of solar installation.

Earn credits for excess solar energy you generate.

The South Carolina Solar Energy Tax Credit is one of the largest state tax credits for solar in the entire country. It provides a tax credit in the amount of 25% of your system.

Are you a self-motivated individual with a passion for sales and an interest in renewable energy? We have an exciting opportunity for a Solar Sales Representative to join our team!

Upgrading to solar offers many benefits, including decreased monthly electricity bills, increased home resale value, protection from power outages, reduced carbon footprint, and more. In South Carolina, limited time rebates, incentives, and tax credits further increase the value of transitioning to solar.

If you have a solar system with battery storage, you will have power during a power outage. The battery storage system allows the excess energy generated by your solar panels to be stored and used to power your home when the grid is down.

By installing a solar energy system in South Carolina, homeowners can enjoy a property tax exemption on the added value from their solar panels.

For example, if a property owner in Charleston has a home valued at $200,000 and installs a $25,000 solar panel system, their property taxes would be assessed based on the original value of $200,000, rather than $225,000.

In South Carolina, homeowners associations (HOAs) are unable to forbid the installation of solar panels on your home. However, HOAs may have some authority to regulate the placement and appearance of solar panels. It is advisable to review your HOA guidelines to ensure compliance with rules and regulations.

If you own an electric vehicle, such as a Tesla, or any of the newer electric vehicles, you might have noticed your electricity bill climbing from the home charging of your car. Solar panels are an ideal way to provide cost-efficient renewable energy for your household and EV needs.

Yes, there are federal incentives available for solar installation in Texas. The federal government offers a tax credit known as the Investment Tax Credit (ITC) for residential and commercial solar projects. This credit allows you to deduct a percentage of the total solar installation cost from your federal taxes. However, the availability and percentage of the tax credit may vary, so it’s essential to consult with a SuperGreen expert to determine the specific benefits you qualify for. Besides the ITC, there are other state, local, and federal incentives that might further enhance your solar investment.

At SuperGreen Solutions, we understand your ambition to create a better world for our planet. To support this cause and make the transition as seamless and hassle-free as possible, we want to become your ally in attaining sustainable green living. Our comprehensive selection of green energy solutions provides the means, while our advice and continual assistance ensure your mission succeeds.

SuperGreen Solutions is a leading green initiatives partner helping homeowners reduce their climate impact through renewable energy solutions.

Copyright © 2023 Super Green Solutions – All rights reserved Privacy Policy